Some fear that a compliance management solution is both costly and time-consuming to implement. But that’s not the case.

It’s true that digital transformation isn’t always the answer. And sometimes migrating towards digital solutions isn’t the right choice.

But the thing is that digital solutions don’t work as stand-alone tools; using them requires a top-down synergistic strategy. Failure only happens when a compliance management solution is reduced to a mere experimental instrument.

When managing compliance, it pays off going digital. Believe us, we’ve seen all our clients successfully transform their businesses with a digital solution.

After you’ve read this blog post, you’ll realize just how harmful it can be for your business to stick to legacy audit systems and fragmented compliance processes. So, read on and save yourself the trouble.

Digital transformation isn’t just a trend

The ever-changing regulatory trends and risk scenarios shape compliance practices. And issues in risk management and compliance arise when companies fail to react in real-time. In other words, using a compliance management solution isn’t just a trend; it’s a continuous need for all business owners.

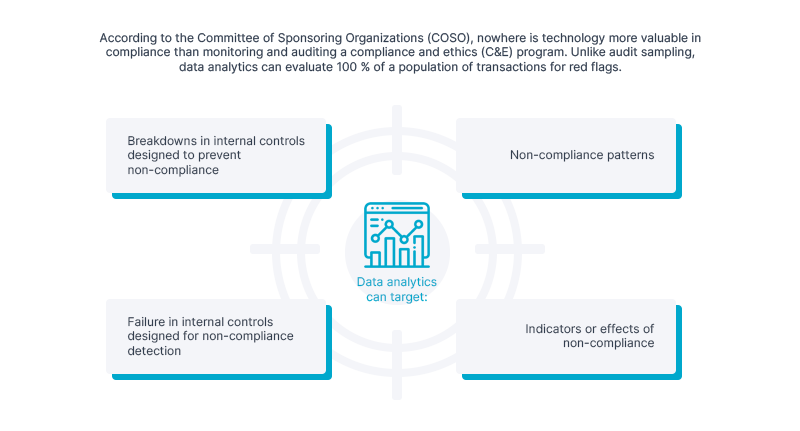

In a 2021 survey conducted by KPMG, 67 % of respondents agreed that the use of automation and technology is the most important ethics and compliance activity to enhance. Of other activities, they also suggested that data analytics, regulatory change management, risk assessment, as well as monitoring and testing should be improved.

Let’s take the National Science Foundation (NSF) as an example.

NSF’s deployment of their Data Analytics Audit is a clear indicator of the increasing prevalence of data analytics in research administration compliance. In their 2016 NSF Office of Inspector General (OIG) Data Analytics Audits, findings showed several unallowable costs and inadequate documentation. Some of these recurring questionable costs included transactions or expenditures related to:

- Senior personnel salaries

- Summer salary

- Cost transfers

- Equipment

- Participant support costs

- Travel (meals, conferences, and foreign travel)

Identifying what costs might raise red flags empowered NSF to craft an effective audit action.

Using data analytics, NSF auditors ran transactional reports to track suspicious spending patterns. As a result, they quickly detected costs that required more supporting documentation.

Silos are the real issue

Nowadays, doing compliance comes with various challenges. These challenges include remote environments, managerial differences, and the lack of collaboration tools. All these factors can compartmentalize compliance initiatives and possibly create cross-informational or leadership silos.

Silos can cause segmentation which hurts team productivity and cohesion. And according to CFO Magazine, a siloed approach to risk assessment and management can lead to less collaboration and blind compliance goals.

If your organization operates with multiple subsidiaries and numerous business functions, communication silos can be detrimental.

And when you have a large scope of operational structures, compliance risks spread across corporate functions. Without a unified approach, it’ll be toilsome to understand and respond to such risks.

To eliminate silos, you must have a system or a digital platform that allows seamless communication and information dissemination. Cross-team collaboration using a cloud-based solution eases internal friction because it allows for a single way of managing and receiving data. And when you consolidate your compliance issue handling, you’ll end up with a stronger line of defence when it comes to risk control.

The regulatory landscape is unpredictable

Businesses, government agencies, and company administrators continue to struggle managing compliance requirements due to the unpredictable regulatory landscape.

During the COVID-19 pandemic, treatment and vaccine regulations were made more flexible in order to allow for the rapid development of medicaments. In the US, to support the healthcare industry, regulatory bodies such as the Medicines and Healthcare Products Regulatory Agency (MHRA) and the United States Food and Drug Administration (USFDA) issued standard guidelines to monitor compliance. And when routine inspections were postponed, reporting was shifted to done digitally.

This scenario is a perfect example of how a technology-driven compliance management process easily adapts to the changing regulatory environment.

Therefore, the traditional approaches to compliance may no longer work – especially in extreme circumstances. Utilizing hundreds or thousands of spreadsheets to support compliance processes can be futile. But the proactive and strategic measures that come from digitalization will help company leaders avoid logistical and statistical anomalies.

Inaction is your foe

Leaders at a top U.S. bank saw their lack of an adequate management system to fully comply with anti-money laundering (AML) standards.

The bank’s primary concerns pointed to their low-quality measures and a backlog of 30,000 cases that required a secondary review. Knowing they might have been at risk of violating critical regulatory requirements, they launched a Compliance Center of Excellence.

Ultimately, they decided to design and introduce a thorough quality assurance program, which helped them conduct reviews and periodic audits. It also tracked remediation efforts related to suspicious accounts.

Aside from meeting the bank’s compliance targets and clearing the first 18,000 backlogged AML reviews in just three months, it was able to:

- Prevent a future backlog

- Manage remediation of 40,000 potential control failures

- Increase quality ratings from 80 % to 95 %

(Source: Accenture: Intelligent Compliance: Smarter Way to Face Risk)

Effective compliance starts with the awareness of risks and the fear of non-compliance. And this case shows that fear is not your foe in compliance – inaction is.

Build a strong compliance management solution

We understand that a large-scale digitization can seem overwhelming. But its benefits and long-term value outweigh this feeling.

Together we can build the compliance management solution you’ve always wanted. Aside from our technical expertise, we take pride in our comprehensive consultative approach to solution development.

If you’re ready to start your digital transformation project, book a demo today and we’ll find the perfect digital solution for you and your business.